The Smart Pension Scheme is a salary sacrifice scheme that provides an option for companies to save cash and increase the take home pay or pension contributions made to employees.

In a difficult economic climate, companies are looking at ways to cut costs and reduce overheads. We have recently seen retailers such as Woolworths and Adams go to the wall, victims of the global economic recession. In light of this, salary sacrifice schemes are likely to become increasingly popular.

The scheme works by an employee ceasing to contribute to their pension scheme and instead the employer increases its contribution to the scheme by the same amount.

In the first instance, the employee was paying NICs on contributions to the pension. This was by virtue of their basic pay being taxed, from which a contribution to the pension was then made.

Under the smart pension scheme the employer is now making equivalent contributions which are not taxed. This is because employers do not pay NICs on their pension contributions.

A tax saving is made as national insurance contributions are cut. Ask your accountant for more details about implementing a salary sacrifice scheme.

HMRC provides some guidance on the smart pension salary sacrifice scheme:

- The employee gives up an amount of cash salary equivalent to the contributions they are making to the company’s approved pension scheme.

- The employer agrees to increase employer contributions to the pension scheme by an equivalent amount.

- Employees are notified that the new arrangements will automatically apply from a particular date unless they opt out in advance.

- If they do not opt out at the start, employees cannot opt out again until the first anniversary of the commencement of the scheme, unless they experience a ‘lifestyle change’ (marriage, birth of a child, separation or divorce, death of a partner or child, change from full-time work to part-time).

- Participation in the scheme brings about a change to the terms and conditions of employment of the participants.

- The employee’s previous gross salary (“base salary”) remains the yardstick for other issues (e.g. the calculation of overtime pay, annual salary increases or salary- related benefits).

Worked Example

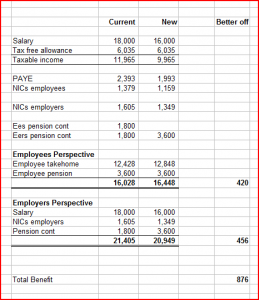

Assume an employee earns £18,000 and both the employee and employer contribute 10% to the employee’s pension scheme. The following example illustrates how a saving of £876 can be made using a salary sacrifice scheme shared between both the employee and employer. To explore further try this salary calculator.

salary sacrifice example